Call us on 0843 005 5211

Feed in Tariff

Feed in Tariff

Feed in Tariffs also referred to as FITs were introduced in April 2010 to replace previously offered government solar panel grants. The newly introduced government feed in tariff scheme provides home owners a long term financial incentive that provides free electricity, energy savings and a tax free income from a government backed guaranteed payment scheme.

Top 4 incentives that the feed in tariff scheme offers for homes with solar panels

- Generation tariff – 43.3p kWh is paid by the feed in tariff for the solar electricity that solar panels generate and is used by your home

- Export tariff – 45.4p per kWh is paid by the feed in tariff for any surplus electricity that has been generated and fed back into the national grid.

- Energy Price protection – Free electricity from solar energy provides total protection from inflating energy prices and substantial long term savings

- RPI linked – Government feed in tariff rates are retail price indexed linked meaning they will over time increase by following the rate of inflation.

How feed in tariff payments are received

Payments are received directly from your chosen energy supplier who are obligated by the governments feed in tariff scheme to pay home owners for electricity that they have generated from renewable sources such as photovoltaic solar panels.

Can solar panels be paid for from finance and still make a tax free return?

Home owners who decide to obtain finance to pay for their solar panels will find that the feed in tariff rates are actually high enough to both provide a return each month to meet the finance loan repayments and also provide a significant amount of savings and an attractive level of tax free income.

How does the feed in tariff work for pv solar panels

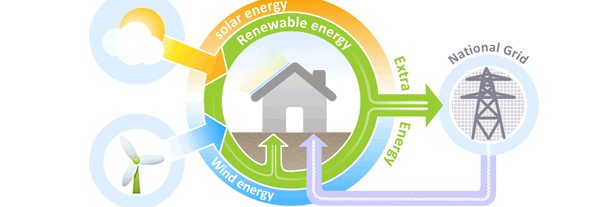

The feed in tariff provides a guaranteed rate for solar electricity that has been generated and used (generation tariff) as well as a separate rate for surplus electricity (export tariff) that gets fed back into the national grid for other energy customers to utilise.

Currently the export tariff for surplus solar electricity that gets fed into the national grid is deemed as being 50% of the total generation meter reading. The government plans to roll-out smart metres by 2020 which will make the export tariff an actual separate reading instead of the estimated percentage method that is currently being used.

Meter readings

As part of the installation of home solar panels a total generation meter is fitted by the solar panel installers to measure the solar electricity that is generated.

Meter readings and feed in tariff payments are normally dealt with by most energy suppliers every quarter. This means most home owners can expect to receive their actual calculated return every few months.

How to apply for your home feed in tariff

- Apply for competitive pricing from up to 3 of our local fully vetted and MCS accredited solar panel companies in your local area

- Choose from the selection of quotations from our independent solar panel installers

- Once your home solar panels have been installed and commissioned our solar panel installers will register your home solar electricity system free of charge with the governments central feed in tariff database and a compliance certificate will then be issued for your home.

- Your home energy supplier will need to be provided with your feed in tariff certificate for your home to be qualified to start receiving both feed in tariffs for generation and export

- You will be informed by your energy provider on how often they will require metre readings and the payment terms available and when you can expect to start receiving your feed in tariff payments

Current feed in tariff rates summary

Feed in Tariff levels for solar panels installed between 15th July 2009 – 31st March 2012

Generation tariff – 43.3 per kWh

Export tariff – 45.4 per kWh

(April 1st 2011 updated rates based on retail price index increase of 4.8%)

How to qualify for the feed in tariff scheme

Government Feed in tariffs have been introduced to provide incentives for encouraging the use of renewable sources for generating electricity and are provided for systems up to the total output of 5 Mega Watts.

Renewable sources of electricity that qualify for the feed in tariff

- Solar electricity (solar energy)

- Hydroelectricity (force of falling or flowing water)

- Wind turbine (kinetic energy / wind power)

The government requirements for solar panels to qualify for the feed in tariff are that they must be supplied and fitted by an MCS accredited solar panel installer. Our free home solar energy survey service provide access to the UK’s largest database of vetted and MCS accredited solar panel companies in your local area, meaning we will put you in touch with reputable solar panel installers who will provide an MCS accredited install at the most competitive price.

For home owner who had previously invested in solar Panels between 15th July 2009 to 31st March 2010 the government has made such installs exempt from having to provide evidence of the installers being MCS accredited.

What is MCS Accreditation

The Microgeneration Certification Scheme provides certificates for microgeneration products and solar panel installers are required to meet government regulations and standards when supplying and installing solar electricity systems under 50kW.

GET ONLINE QUOTE

Solar Panels Information

PV Solar Panels

FAQs

Solar Panels

Solar Panels UK

Solar Panels Cost

Solar Panels Grants

Contact Us

Local Solar Panel Installers

England

Scotland

Wales

Phone

0843 005 5211

Email

[email protected]

Follow us on:

Home

Solar Electricity for homes

Solar Thermal

Feed in Tariff

Solar Panels for your home

Solar Panels FAQ’s

PV Solar Panels

Renewable Heat incentive

Solar Panels UK

Solar Panels Installers

Solar Panels Cost

Solar Panels Grants